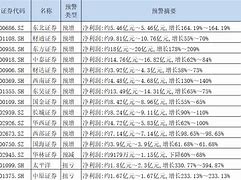

券商股业绩

Certainly! Here's a structured work plan based on the keywords provided:

Work Plan: HalfYear Financial Performance Disclosure

1. Objective:

Analyze and report on the halfyear financial performance of our brokerage firm, focusing on the differentiation in attributable net profits.

2. Resources Required:

Data Sources:

Internal financial reports for the past six months.

Comparative data from previous years and industry benchmarks.

Tools:

Financial analysis software (e.g., Excel for calculations, financial ratios).

Presentation tools (e.g., PowerPoint) for final report compilation.

Access to market research reports and financial news.

3. Risk Assessment:

Data Accuracy:

Ensure the accuracy of financial data and reconcile discrepancies.

Market Volatility:

Potential market fluctuations impacting financial performance.

Regulatory Changes:

Changes in financial reporting standards or regulations affecting disclosures.

Competitive Landscape:

Industry competitors' performances affecting market perception.

4. FollowUp and Evaluation:

Timeline:

Develop a timeline for data collection, analysis, and report drafting.

Review Process:

Regular meetings with stakeholders to review progress and findings.

Presentation:

Prepare a comprehensive report with detailed analysis and strategic recommendations.

Feedback Incorporation:

Incorporate feedback from stakeholders into the final report.

This work plan aims to provide a structured approach to analyzing and reporting on our brokerage firm's halfyear financial performance, emphasizing the noticeable differentiation in attributable net profits.